Introduction:

In a world where financial literacy is as crucial as learning to read and write, navigating the vast sea of personal finance books can be overwhelming. Whether you’re a seasoned investor, a financial novice, or somewhere in between, the right book can significantly illuminate your path toward financial wisdom. That’s why we’ve curated a list of the 10 best nonfiction books for personal finance. These aren’t just books; they’re gateways to financial freedom, each offering unique insights into managing, growing, and understanding your money. For anyone keen on transforming their financial landscape, this selection promises a journey of discovery, empowerment, and profound change.

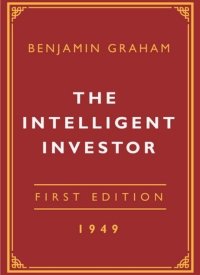

1. “The Intelligent Investor” by Benjamin Graham:

Diving into “The Intelligent Investor” is like embarking on a pilgrimage to the very heart of value investing. Benjamin Graham, the sage of Wall Street, doesn’t just talk finance; he stirs the soul of the reader with principles that challenge the fleeting trends of the market with timeless wisdom. His advocacy for the “margin of safety” — a concept as profound as it is practical — not only secures your investments but teaches a life lesson in caution and discernment. Through vivid analogies and historical insights, Graham doesn’t just educate; he transforms the reader’s understanding of the market. This book is an intellectual feast, leaving you not only financially savvier but deeply reflective on the value of patience and prudence in both investing and life.

2. “The Psychology of Money” by Morgan Housel:

Morgan Housel’s “The Psychology of Money” takes you on an enlightening journey into the heart of what truly shapes our financial lives: our behavior. With compelling stories and keen observations, Housel unveils the complex relationship we have with money, challenging the reader to reconsider their deepest beliefs about wealth and success. Each page is a window into the soul of finance, revealing that our greatest asset or liability is not our bank account but our mindset. The book encourages a profound introspection, urging readers to cultivate a healthier, more mindful relationship with money. It’s a transformative read, painting a vivid picture of how to achieve financial peace by aligning our values with our finances.

3. “The Total Money Makeover” by Dave Ramsey:

Dave Ramsey’s “The Total Money Makeover” is a battle cry for personal finance liberation. With a conversational tone that feels like a heart-to-heart chat with a wise friend, Ramsey lays out a simple yet powerful plan to overhaul your finances. The book is filled with real-life success stories that inspire and motivate, making the dream of financial freedom feel attainable. Ramsey’s straightforward approach cuts through the noise, offering clear, actionable steps that challenge the reader to take charge of their financial destiny. It’s not just a book; it’s a journey of transformation, one that promises not just a healthier bank account but a richer life.

4. “Think and Grow Rich” by Napoleon Hill:

“Think and Grow Rich” transcends the genre of personal finance to offer a philosophy for success that has inspired millions. Napoleon Hill’s masterpiece is a tapestry of stories, philosophies, and principles that spark the flame of ambition in the heart of every reader. The book invites you to delve into the mindset of success, weaving in suspense and anticipation as it reveals the ‘secret’ to wealth and achievement. Hill’s work is a testament to the power of thought and belief in shaping our financial destinies, encouraging readers to dream big and pursue those dreams with unwavering faith and persistence. It’s an intellectual and emotional odyssey that leaves you charged with the energy to manifest your financial and personal aspirations.

5. “Your Money or Your Life” by Vicki Robin and Joe Dominguez:

In “Your Money or Your Life,” Vicki Robin and Joe Dominguez offer more than financial advice; they present a revolutionary lifestyle. This book challenges you to reevaluate your relationship with money, urging a profound reflection on how your financial decisions align with your values and life goals. Through engaging narratives and practical exercises, the authors guide you toward achieving financial independence through mindfulness, simplicity, and sustainability. It’s a journey that not only changes how you handle money but how you live your life, encouraging a deep introspection and a renewed commitment to living deliberately and meaningfully.

6. “The Millionaire Next Door” by Thomas J. Stanley and William D. Danko:

This groundbreaking book shatters the stereotypes of wealth with compelling research and captivating stories of real-life millionaires who live right next door. Stanley and Danko reveal that true wealth is often hidden beneath a veneer of simplicity. Through engaging analysis and vivid anecdotes, they expose the habits and lifestyles that lead to true financial success. Reading this book is like getting a backstage pass to the lives of the wealthy, offering both inspiration and practical advice on accumulating wealth. It’s a powerful reminder that financial abundance often comes to those who adopt a mindset of frugality, investment, and perseverance. “The Millionaire Next Door” not only enhances your financial literacy but also cultivates an appreciation for the unglamorous, disciplined path to prosperity. It encourages a deep, reflective thinking about our own spending habits and financial goals, pushing us towards a more thoughtful and strategic approach to wealth.

This groundbreaking book shatters the stereotypes of wealth with compelling research and captivating stories of real-life millionaires who live right next door. Stanley and Danko reveal that true wealth is often hidden beneath a veneer of simplicity. Through engaging analysis and vivid anecdotes, they expose the habits and lifestyles that lead to true financial success. Reading this book is like getting a backstage pass to the lives of the wealthy, offering both inspiration and practical advice on accumulating wealth. It’s a powerful reminder that financial abundance often comes to those who adopt a mindset of frugality, investment, and perseverance. “The Millionaire Next Door” not only enhances your financial literacy but also cultivates an appreciation for the unglamorous, disciplined path to prosperity. It encourages a deep, reflective thinking about our own spending habits and financial goals, pushing us towards a more thoughtful and strategic approach to wealth.

7. “I Will Teach You to Be Rich” by Ramit Sethi:

Ramit Sethi’s approach in “I Will Teach You to Be Rich” is refreshingly honest and incredibly practical, making personal finance both accessible and engaging. This book is like a personal finance coach that walks you through a six-week program to transform your financial life. Sethi combines a blend of psychological insights with actionable tools, addressing everything from saving to spending to investing with a wit that keeps you hooked. The conversational tone makes complex financial concepts easy to understand, encouraging readers to take immediate action. This book doesn’t just aim to educate; it inspires a proactive stance towards creating wealth, offering a blueprint for financial success that feels both innovative and achievable.

8. “The Richest Man in Babylon” by George S. Clason:

Set against the backdrop of ancient Babylon, Clason’s book is a timeless classic that imparts financial wisdom through parables. The vivid imagery and storytelling immerse the reader in a world where simple, yet profound financial principles come to life. Each tale is a lesson in financial discipline, saving, and investing, teaching the reader the value of managing money wisely. “The Richest Man in Babylon” is a treasure trove of financial morals that resonate across generations, encouraging a thoughtful and disciplined approach to personal finance. The historical setting adds a layer of fascination, making the journey to financial wisdom both engaging and culturally enriching.

9. “The Little Book of Common Sense Investing” by John C. Bogle:

John C. Bogle, the founder of Vanguard, offers a compelling argument for the simplicity and efficacy of index fund investing in “The Little Book of Common Sense Investing.” This book demystifies the stock market, providing clear, concise advice that empowers the average investor. Bogle’s authoritative voice and confidence in his approach shine through, providing a sense of trust and security in his recommendations. The book is a beacon for those lost in the complexity of investing, guiding readers towards a straightforward, effective strategy for building wealth. It’s an essential read for anyone looking to navigate the market with confidence and simplicity, promoting a reflective and informed approach to investing.

10. “The Simple Path to Wealth” by JL Collins:

JL Collins presents a straightforward guide to financial independence and wealth building in “The Simple Path to Wealth.” With a blend of personal anecdotes and practical advice, Collins lays out a strategy that is both easy to understand and implement. The book fosters an inspiring sense of empowerment, making the reader feel that achieving financial freedom is within reach. Collins’ conversational tone and clear explanations demystify the complexities of financial planning and investing, encouraging the reader to take control of their financial future. This book is a journey towards simplifying your finances while maximizing your wealth, providing the tools and confidence needed to take action.

Conclusion:

The journey through these 10 best nonfiction books for personal finance is more than an educational endeavor; it’s a transformative experience that offers a wealth of knowledge, strategies, and insights for managing your money. Each book, with its unique perspective and expertise, contributes to a comprehensive understanding of personal finance that can empower anyone to achieve financial freedom. From the foundational principles of investing to the psychological aspects of money management, these books provide the guidance, motivation, and inspiration needed to navigate your financial journey with confidence. Embrace the wisdom contained within these pages, and watch as the lessons reshape your approach to personal finance, leading you to a more secure, prosperous, and mindful financial future.